The article below provides a good overview of how Intel’s mobility strategy is coming together. The global chipmaker has made two large investments that are shaping up to position it as a global powerhouse in the emerging mobility sector. The Mobileye acquisition is well-documented now and has generally served as the firm’s mobility division. A global leader in its own right, the Mobileye deal was about quickly advancing Intel into the midst of the corporate technology development and commercialization frenzy about future human mobility. Now with the Moovit acquisition, the Company is positioning itself as a global platform for its robotaxi-focused business plans.

With plans remaining on track to launch in 2022, we see the Intel company system as now clearly at the head of the class in the space it’s trying to carve out. The expanded structure substantially deepens Mobileye’s ability to provide a complete service to the business model that is banking on people not always owning a vehicle. As it stands today, Intel may be alone it an ability to provide a full package including: hardware, sensors, software, integration and large-scale services.

Intel Distances Itself From The Autonomous Vehicle Competition With $1 Billion Acquisition

May 12, 2020

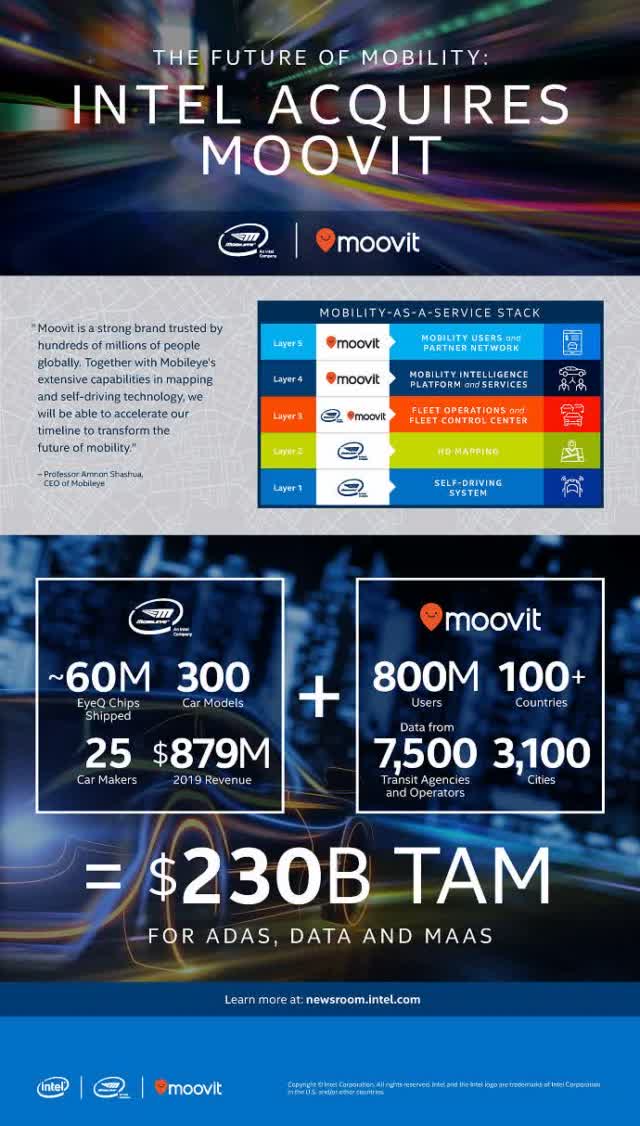

Intel recently acquired Moovit for almost $1 billion, focused on the services aspects of robotaxis, and revealed some new aspects to its strategy.

The acquisition displays Intel’s comprehensive approach to consumer autonomous vehicles and robotaxis, still on track for 2022.

Both companies will remain independent, but will closely collaborate.

Intel is the only provider with a full silicon to mapping to services stack for this >$200 billion 2030 market. This makes it the definite leader.

(Note: MaaS stands for Mobility-as-a-Service, and basically means robotaxis. SDS stands for self-driving system.)

Intel (INTC) announced the acquisition of Moovit on May 4, which I believe marks the next, crucial step in Mobileye’s pursuit of robotaxi domination, as this is likely to significantly strengthen its IP for the end-user/services layer. Mobileye itself up to now was primarily focused on software and hardware (EyeQ chips) for autonomous vehicles, with services enabled through partnerships.

Hence, the current acquisition deepens Mobileye’s ability to provide complete solutions for robotaxis, and it might be the only company that can provide everything: hardware, sensors, software, integration and large-scale services.

Mobileye confirmed it remains on track for 2022 start of this business. From silicon to actual services, this could grow quickly to an over-$200 billion market by 2030. Given Mobileye’s current leading position in ADAS, and important investments such as the current Moovit acquisition, this makes it likely the company will carry over its leadership in ADAS into these new segments.

From a return perspective, since the cost of a self-driving system will be on the order of the most expensive Xeon server processors, and with an opportunity of millions of vehicles per year (not even to mention the opportunity of robotaxi services), the revenue this could generate for Mobileye and Intel is vast.

Moovit acquisition

To start with the basic facts, Intel acquired Moovit for $900 million, a 200-employee company. Moovit’s app provides trip planning capabilities by “combining public transportation, bicycle and scooter services, ride-hailing, and car-sharing”. Moovit has 800 million users across 102 countries, up 7x in two years. It gets data from over 7500 agencies for 3100 cities. Intel also notes that Moovit has already signed partnerships with major ride-sharing operators for MaaS.

Moovit will remain an independent company, just like Mobileye, but of course, they will closely work together to accomplish their expanded vision. So, it seems that there will be few near-term changes. Moovit’s CEO will become Executive Vice President at Mobileye.

Mobileye, on the other hand, is the leading automotive ADAS (advanced driving assistance systems) provider, but given the transportation revolution to autonomous driving – which was the reason for Intel’s acquisition in 2017 – Mobileye wants to become a “complete (full-stack) mobility provider”.

Given that Mobileye expects autonomous driving to flourish first in a robotaxi market, this has necessitated the company to pivot into this space. To that end, Mobileye has already announced a multitude of partnerships to date for geographies spanning Israel, France (and Europe), China, South Korea, and entering the U.S. by itself in 2023. Since Mobileye will provide the self-driving system (SDS), those partnerships have been mostly focused on acquiring capabilities for the “upper layers” of end-market robotaxi services.

So, generally speaking, with the Moovit acquisition, it seems that Intel/Mobileye wanted to brings some of those upper-layer capabilities (top of the value chain) in-house. For example, in the Israel Pinta JV with Volkswagen (VLKAY) and Champion Motors, Mobileye provides capabilities for layer 1, Volkswagen handles layer 2, Champion does layer 3, and all three work together on layers 4 and 5.

Mobileye detailed in November that it expects its complete market opportunity across these layers, from hardware to mapping to services, to be worth over $230 billion by 2030.

“Moovit’s massive global user base, proprietary transportation data, global editors community, strong partnerships with key transit and mobility ecosystem partners, and highly skilled team is what makes them a great investment,” said Professor Amnon Shashua, CEO of Mobileye.

Expanding Mobileye’s strategy: XaaS, RaaS, VaaS

In an editorial, Mobileye CEO Amnon Shashua went into some more details about the acquisition and its strategy.

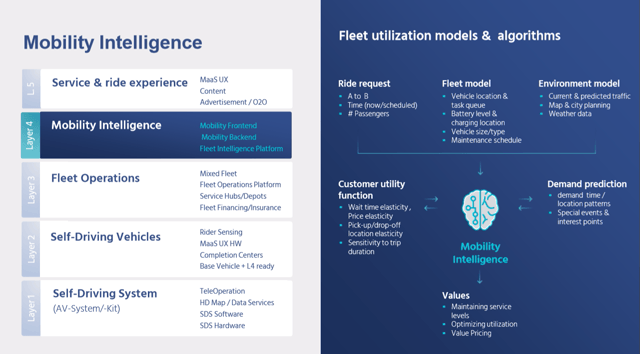

As mentioned above, Mobileye wants to become active at every layer of the MaaS value chain (that it claims will be worth $160 billion by 2030). To offer a value proposition at each layer, Mobileye says it has developed a “multimodal XaaS strategy”, which it calls unique to Mobileye, as it differs from all other companies.

Mobileye says this involves three “critical assets”:

- Mobility Intelligence (layer 4) based on “data-driven real-time demand and supply insights”.

- The transit operators’ operational expertise. This refers to the “collaborative go-to-market models” via Mobileye’s partnerships. They include VaaS and RaaS.

- Moovit finally adds its data and user base, but the company also “owns underlying assets, capabilities and a partners network”.

What does this all mean?

First, the mobility intelligence asset allows for “various service models such as origin-to-destination, first/last mile and dynamically routed shuttles”.

Secondly, Mobileye refers to its go-to-market approaches as VaaS and RaaS, respectively Vehicle- and Ride-as-a-Service.

- RaaS enables an existing service operator to “summon” an automated mobility solution to cater for un-addressable demand under its service umbrella.

- VaaS is a further integrated model in which we offer a dedicated fleet of autonomous vehicles/shuttles to be acquired and assimilated into the transit operator’s backbone and control center together with the Mobility Intelligence software, which ensures efficient use of that capital.

Thirdly, Moovit’s assets will “enable us to turn on affordable and demand-optimized driverless mobility services almost anywhere in the world”.

Technological Takeaway

From a technological perspective, it should be clear that Mobileye has a complete strategy. It is not just selling silicon (EyeQ chips), not just algorithms, and not just sensors. It’s selling all of the above, and then also integrating it into a complete self-driving system (SDS).

Besides SDS, it is now clear that Mobileye will also have a complete package for a robotaxi business, as clearly, a MaaS business involves more than just acquiring a fleet of thousands of vehicles with an SDS.

Mobileye had already revealed that it will go into this through collaborations, and the Moovit acquisition has revealed some more details. It has invested in some critical, differentiated assets such as Mobility Intelligence software, and now also Moovit.

This will enable Mobileye to collaborate with transit/service operators and go to market through what it calls RaaS and VaaS models.

In other words, given this information, the chance that you’ll be able to use a “Mobileye One” service or app, akin to “Waymo One”, seems slim. Instead, it seems Mobileye wants to gain dominance by being the autonomous mobility provider of choice of existing transit operators across the globe.

This is, of course, in line with the collaborative approach to entering global MaaS markers Mobileye has displayed to date.

From what I can tell, this may give Mobileye the best of all worlds: it is investing in the best, most secure autonomous vehicles, and entering robotaxis through an efficient model.

Risks

There are many competitors coming from different angles: hardware companies such as Qualcomm (QCOM) and Nvidia (NVDA), ride-hailing companies such as Uber (UBER), Google (GOOG), start-ups and more.

Everything also starts with a reliable, secure self-driving system. We have seen in the past companies delaying the introduction of their robotaxi businesses.

While Mobileye claims a $230 billion 2030 market opportunity, this, of course, should be taken as a very rough estimate.

Near term, the automotive industry is facing headwinds from COVID-19. Intel is expecting lower growth from Mobileye this year, but this should not affect the longer-term (2022+) period discussed in this article.

Investor Takeaway

Mobileye is positioning itself for a $160 billion robotaxi/MaaS opportunity and a $70 billion self-driving systems opportunity by 2030. Even if gross estimates, the opportunity is vast. But as anyone who has followed this space is aware, so is the competition, consisting of other hardware/platforms providers, start-ups, and in-house self-driving efforts of automakers, including Tesla (TSLA).

However, of all of those active to revolutionize transportation into the autonomous era, only one really has the capability to provide a full-stack solution, and it is already the leader in ADAS (L1/L2/L2+): Mobileye. As such, Mobileye is best-positioned for leadership into those new segments.

I have asked Intel before to provide more stats about how its self-driving fleet is doing, but it seems that Mobileye is still on track for its goal to start a global robotaxi/MaaS business in 2022, using its own self-driving system (SDS) and compute.

The present Moovit acquisition significantly strengthens the overall Intel value proposition by providing key assets for the top-level services, which also includes Mobility Intelligence. This could be seen as a clear differentiator for robotaxis, as it is highly collaborative and leverages existing operators’ strengths.

While this segment evolves, Mobileye will be further investing to compete in SDS for consumer AVs (akin to Tesla’s FSD), which is expected to start around 2025.

While these two segments (robotaxis and consumer AVs) might take one to two decades to really unfold, it should be clear that Mobileye is the only competitor in these spaces with assets and investments for global, full-stack go-to-market solutions. For example, it has the largest announced coverage for a global robotaxi business. This, obviously, gives it a leadership position and builds on top of an already quickly growing and highly profitable ADAS business. Mobileye is already making money, while others are just spending it.

Summing up, though Intel’s data economy portfolio is much broader than autonomous driving, anyone who wants to invest in (the leader in) this space should consider a position in Intel.

About GLDPartners Mobility Solutions: GLDPartners is a recognized global authority around a range of supply chain, transportation & technology issues. GLDPartners Mobility Solutions specializes in testing and development facilities, infrastructure project development, mobility sector economic development strategies and regional mobility strategies. Please see the company’s website: GLDPartners Mobility Solutions. This post reflects editorial content with commentary about the subject matter referenced and is not intended to be promotional in nature.